News & Events

Find an ATM

Find a NO-FEE MoneyPass ATM near you.

Find a Branch

Locate a branch near you or call

Did You Receive an Unexpected Deposit From the IRS?

Posted

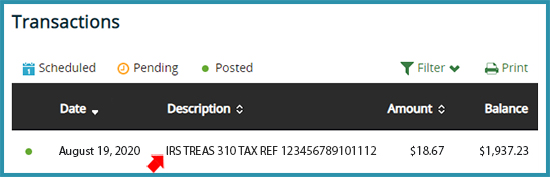

You may receive an IRS interest payment similar to this.

The Internal Revenue Service (IRS) began issuing tax refund interest payments recently. You may be one of an estimated 13.9 million individual income taxpayers who are owed an interest payment on their 2019 federal income tax refund. The average interest amount owed is $18 but the exact amount received is dependent on the size of each refund.

Individual taxpayers who filed their return by the July 15 deadline and either received a refund in the past three months or will receive a refund may qualify. The refund interest payment does not apply to businesses. Additional information on the IRS phone system shares, “If your federal tax refund was dated or deposited April 22, 2020 through July 22, 2020, you may have received an additional payment reflecting the interest on that refund you were owed.”

According to the IRS website, the 2019 interest payment process began on August 18. As a result, First State Bank of St. Charles customers who elected to receive their tax refund by direct deposit and are owed interest on their tax return may notice a deposit from the IRS sometime following that date. Customers who received their tax refund by paper check will also receive their refund interest payment by mail.

Log in to your bank account via online banking for the most convenient and timely monitoring of deposits to your account as monthly account statements will reflect deposits made only within a specific date range. Contact your local IRS office or visit the IRS website at www.irs.gov and type “refund interest payment” in the search bar for more information.