News & Events

Find a Branch

Locate a branch near you or call

Are Your Accounts Covered with FDIC Insurance?

Posted

In the wake of the Silicon Valley Bank collapse, our staff has received many questions regarding the security of their funds. It is through these conversations that we understand the urgency of educating our customers and fellow community members on the ways you can protect your funds with Federal Deposit Insurance Corporation (FDIC) insurance.

As CEO & President of First State Bank, I am aware of the importance of regulations that promote fairness and protect consumers. Additionally, I serve as Chair of the Federal Reserve Bank of St. Louis’s Community Depository Institutions Advisory Council (CDIAC) and am the former Chair of the American Bankers Association (ABA) Community Bankers Council and a member of the ABA Board of Directors. In these roles, I focus on communicating the impact of policy decisions on the people we serve and providing input on ways to ensure the safety and stability in the banking industry.

First State Bank agrees with Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and FDIC Chairman Martin J. Gruenberg, “The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry.” We understand concerns regarding the impact of this bank failure on the entire banking industry and hope that our cosign can calm those worries.

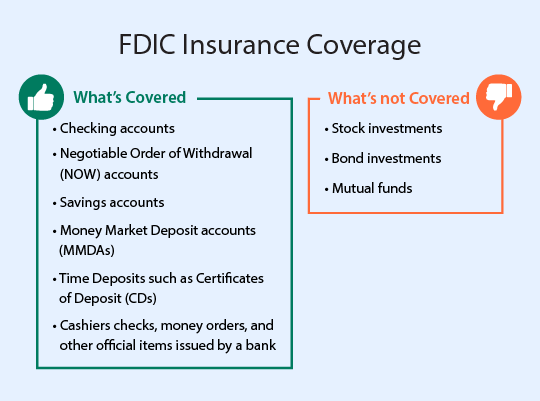

One of the most common questions our team has received is “What is FDIC insurance and am I covered?” Here’s the answer: The FDIC insures up to $250,000 in a deposit account if the unlikely event of bank failure were to occur. You do not have to purchase this insurance, just by opening a deposit account with First State Bank of St. Charles or another FDIC-insured bank, you are automatically covered.

“First State Bank has been dedicated to earning the community’s trust for more than 150 years.”

– Luanne Cundiff, President and CEO

For the average person, the $250,000 standard insurance amount is more than sufficient. However, there are many people who require additional coverage. It is important to note that the $250,000 figure is per depositor, per insured bank, and for each account ownership category. Increasing your FDIC insurance is possible when you add a spouse to a deposit account, set up trusts with multiple beneficiaries, or establish multiple account types.

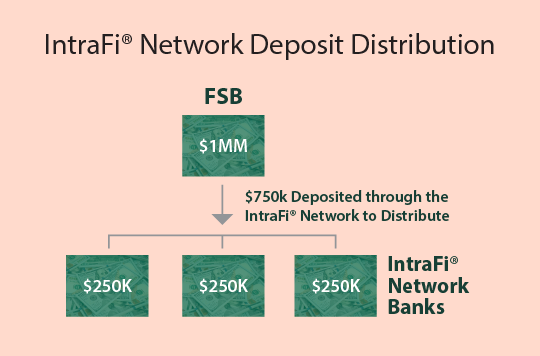

You may think that splitting your funds across several institutions will keep you covered, but that isn’t necessary. First State Bank, like thousands of other financial institutions, is a member of the IntraFi® network.1 This network allows customers to bank with us even if they have accounts that exceed the $250,000 standard insurance amount. Funds are conveniently and securely 2 put into demand deposit accounts, money market deposit accounts, or CDs based on the specific needs of account holders.

IntraFi® is a great option for businesses carrying high balances that may not be eligible for standard FDIC insurance. Contact one of our business experts to find out how we can help.

Lastly, we truly value the rapport we have with each of our customers. We have had so many optimistic conversations in the last few weeks and appreciate the opportunity to share our expertise to alleviate concerns. To see how the insurance rules and limits apply specifically to your accounts, I recommend using the FDIC’s free electronic deposit insurance estimator tool. If you need assistance using this tool, have questions or concerns regarding FDIC insurance, or would like to open or modify an account, please schedule an appointment with a First State Bank banking center manager or contact our Customer Care team at 636-940-5555.

Additional Resources

Have an account elsewhere? Check to see if your money is insured .

Check here to see if a specific account type is FDIC-insured.

Read more on actions the U.S. Department of the Treasury, Federal Reserve, and FDIC are taking to protect the U.S. economy and depositors at Silicon Valley Bank and Signature Bank.

Summary of FDIC Deposit Insurance Coverage Limits

1 Full list of participating financial institutions in the IntraFi® network .

2 The IntraFi® Statement on Safety of Deposits